The COVID-19 virus will have a serious financial impact on the economy. There is still a lot of uncertainty pertaining to the extent that GDP will contract in the UK. The contraction of the economy is directly proportional to persistence of the outbreak.

The UK will enter a deep recession with GDP expected to contract by at least around 5% in 2020 and only have gradual growth in 2021.

From our perspective we agree the economy will go into a deep recession but that it is very difficult to quantify and predict the extent of this. We feel that we are in unchartered territory and there is no comparable benchmark to really understand its effect.

So, in our opinion the best thing is to position your business in the best possible way to fight any adversity it may face both in the short and medium term.

To combat this governments around the world have approved massive stimulus packages. Most notably the US has approved a stimulus package of $2tn.

The UK has announced a GBP330bn package of support for businesses. This is on top of the previously announced GBP30bn support package.

Cashflow projections are vital to your business in these uncertain times. You need to understand what are the cashflow requirements of your business in order to ensure its survival into the future.

IN A FINANCIAL CRISIS SOMETIMES, SURVIVAL WILL EQUATE TO FUTURE GROWTH

The financial crisis could continue for a prolonged period, so we recommend that you start with a weekly cashflow forecast for the next few weeks especially during the lockdown period and thereafter prepare a 12-month cashflow forecast.

It is imperative to include a breakeven/“stress test” analysis in the cashflow forecast of your business by looking at different scenario that can come about from this crisis.

Some of the advantages of preparing a cashflow projection:

- A short term weekly cashflow projection will allow you to understand your immediate needs to get through this trying period.

- As a minimum, a cashflow projection will allow you to understand if a capital injection is required and if so, how much and when you need to obtain the funding?

- Provide you with an advantage in obtaining a package of support for businesses offered by the UK government.

- It allows you to consider and plan how to implement efficiencies in your business.

- If your projection indicates that your business will have a cashflow shortage you can assess whether to obtain Debt or Equity Finance.

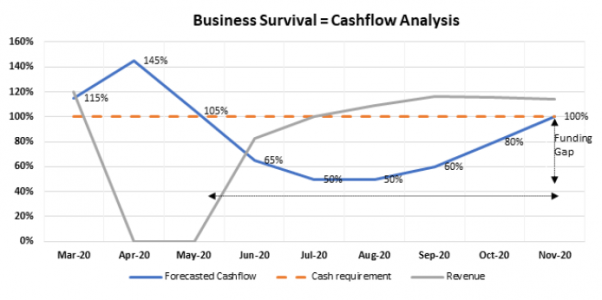

Please see below an illustrative example of our discussion:

FIGURE 1.

Please note: the above graph is used to best illustrate the movement of cashflows and revenue within businesses during the lock down period. This doesn’t consider any market sector but rather considers the general economy. The above graph assumes that the lockdown period will not be extended past May 2020.

The above graph shows the relationship between your forecasted cashflow as a percentage of your cash requirements.

We feel a lot of businesses will really feel the effect of the lock down moving into June if most of your customers have credit terms.

We wanted to illustrate that you don’t need to only understand your cashflow requirements over the lockdown period but also the impact it can have further down the line. Where the forecasted cashflow drops below 100% shows the period where funding may be required.

The graph above illustrates that you will have a cashflow shortage starting in June and you will only exit this position only in November 2020. Furthermore, the maximum actual cashflow shortfall will be 50% of your cashflow requirement and this will be experienced from July and August 2020.

Incorporated in the above graph is also the relationship between your revenue as a percentage of your cashflow requirements. Again, we wanted to illustrate the effect that this lockdown can have on your revenue.

We do not believe that it is practical to assume that your business will be making the same turnover immediately after the lock down period ends. A detailed forecast of your revenue needs to be considered in order to understand your business’s breakeven point and at which point it will become profitable again. Breakeven is illustrated in the graph at the point that the “revenue” and “cash requirement” lines cross.

Date: Tuesday 14th Apr 2020